Quick question: When’s the last time you thought about your cash flow? If you’re like us, it was probably around the Obama administration time. Or… never. No judgment here. Our high school or college econ classes definitely failed to mention it, and we’ll assume you’re not a licensed CPA.

But, we’ll go ahead and say something we all need to hear: you cannot run a successful business without a grounded understanding – and application – of cash flow.

Let’s breakdown what we mean when we say most first-time freelancers don’t know how much of their revenue they should set aside for taxes. Also, many don’t know they have to put aside any money for taxes.

About 78% of freelancers still keep all their personal and business money in one account, rather than having a separate business account. This makes financial knots difficult to comb out around tax season.

Regardless of the setup, unpredictable or disorganized cash flow is often the downfall of even the best business idea.

Getting a good grip on cash flow will keep your business moving forward by forcing you to understand spending, help you avoid debt, and train you ahead of taking on even bigger projects and hiring employees or other freelancers down the road. At the end of the day, cash flow is critical to building a healthy and successful business.

Track your spending

Doing a cash flow assessment is like taking the pulse of your business. And tracking your spending, specifically, is like taking a good look at yourself in the mirror. Let’s do an exercise and answer the following questions:

-

- What’s your spending like? (How susceptible are you to impulse purchases? How expensive is your caffeine addiction? Where is your money being spent? How much?)

-

- What’s the timing of your inflow and outflow? (Are you being clear with clients on payment deadlines? Are your credit card payments on time? Are you paying yourself a personal salary from your business account? How often?)

- How much money do you need to break even? How much money do you actually need to grow?

When you regularly check cash flow, you get a super clear picture of your business’s financial health. You might learn something interesting or find you need to make major changes. Perhaps you’re too lax about invoicing and not insisting clients pay you in a timely period (i.e., within 15-30 days of invoicing).

Maybe it’s time to raise your rates.

How many times have you hosted a client dinner, paid for a Facebook ad, or taken a taxi without thinking about marking that expense for tax deduction? If you’re not in tune with your cash flow, probably too many times to count. Another massive benefit of tracking your business spending is you’re far less likely to miss a deduction.

Once you start noting every business expense, tax season comes around, and you’ll be writing off far more than you expected. That means more money for you and less money owed to the IRS. (High five for responsible spending!)

Avoid debt

Tracking cash flow can help prevent the worst thing that can happen to your business.

You guessed it.

Debt.

If we’ve learned anything in the last year, we’ve learned the importance of stocking up on emergency savings. This goes for your freelance business as well. Stashing cash is an important habit to develop, especially as a freelancer.

If the last 18 months have taught us anything, it’s that you never know when a pandemic could hit, your entire state could experience a power outage, or some other catastrophe could hit! And the only way to have some measure of stability – or sense of control – is to be prepared with even a small safety net that can pull your business through hard times.

Apart from major disasters, life happens. Sometimes you need a new computer, a refresher course in marketing or some other bigger purchase. This money should be there for you whenever you might need it without taking on any debt and interest. You got into freelancing anyway – at least in part – to grow your wealth and options, right?!

To help get into the habit of saving alongside managing your everyday cash flow, make it a goal to minimize the amount of money kept in your business account to what you know you really need for business-related expenses and no more. Keep a bigger portion of your income consistently flowing toward your business savings (different than personal savings), personal salary, and roughly the amount you likely owe in taxes.

If you don’t know this last number, it’s worth talking to someone for an estimate or setting around 15-20% of every payment toward a tax savings account. By starting to allocate every payment in this way, you’ll soon get ahead of your running cash flow needs and avoid ever having to see debt again.

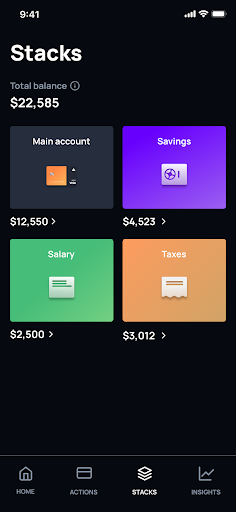

This may sound like a lot – and yes, it can take some effort to get into the swing. Or you can consider investing in a tool that does all this calculation and allocation automatically for you! There are many all-in-one solutions out on the market today, like Lance. It’s a business banking account made for freelancers that automatically divvies up your income into a few preset “stacks,” or subaccounts, every time you get paid.

Checking up on your cash flow might lead you to realize some hard truths. You may realize you’ve been severely undervaluing yourself, or you’ve been lax about tracking down client payments. Freelancers often avoid talking about payments, payment deadlines and stop work consequences with their clients.

However, those avoidance behaviors only cause more issues – lost time and resources – far quicker than you may think. Part of understanding cash flow and using it to your advantage is all about learning how much revenue you need to maintain and grow your business – and exactly when you need it.

Cash flow, baby. It’s all there.

Train for growth

After the basics are covered, becoming best friends with your cash flow has another fantastic advantage: it can help prepare you to take on bigger projects, clients, and even business growth in the future.

If you’re ever hoping to grow in just about any way with your business, you’ll first need to understand your own cash flow before you can take on more complicated or expensive opportunities. Every business is benefitted by a knowledge of that business – and how to make it more efficient and profitable. You gain a better understanding of your business by learning – and revisiting your cashflow.

However, you make yourself invaluable to clients and projects if you’re able to understand their businesses as well. Don’t be afraid to dive into the nitty-gritty of your finances. It helps you build a solid foundation and prepares you to take on real, solid growth in the long run.

Entrepreneurship is a volatile space. One in every 5 small businesses fail in their first year, 1 in 3 fail in their second year, and half of all small businesses fail after 5 years. That’s a lot of failed businesses. Not trying to knock that wind out of your sails, but when we look at the primary reasons for business failure, one of the top three is lack of solid money management. Many businesses run out of cash!

How does that happen?! Well, it happens every day because, while small business owners may feel like their business is rolling, there’s a very reactive cycle taking hold. Freelancers often get caught up in tracking each payment and bill as it comes into the inbox.

However, there’s rarely a higher-level tracking set up in those first few years that accounts for how much money is coming in and going out – and when exactly. This cash flow disconnect is exactly – and staying ahead of payments and clients – is what most often leads to funding shortfalls, which in turn lead to the demise of thousands of small businesses a year.

If you take one thing away here, it should be this – No matter how good you are at marketing, no matter how well you understand your customer, no matter how kicka** your product is, if you suffer from disorganization and a lack of cash flow know-how, your business is more likely to fail. And your thriving Instagram page won’t save you.

If you want to survive and thrive as a freelancer, get to know your cash flow on an intimate level. Take some time every day to track your revenue, spending, profit, and savings. Or find tools to help you get back on top! You’ll reap serious benefits, like financial clarity, easier tax handling, preparation for growth, the lesser likelihood of debt and failure, to name a few. And you’ll likely reap the benefits far sooner than you expect.

Bonus Tip: To get more clients and ensure that you get a continuous cash flow throughout the year, consider generating outstanding proposals with Prospero. Sign up today!

Author’s Bio:

Polina Fradkin is Head of Content and Marketing at Lance, the self-driving bank account for freelancers. She’s confident that one day everyone will be a freelancer and that making finances a breeze for the self-employed is long overdue.