Perhaps you’re getting started as an entrepreneur. If that’s the case, setting up your first business contract can be nerve-wracking. As your business grows, you will interact with various entities — employees, customers, suppliers, shareholders, and cofounders. And even though they have different roles in the food chain, they share a common factor. That is the need for a solid contract to build strong business relations. Thus, you must make sure your business contract accurately reflects the terms of your collaboration.

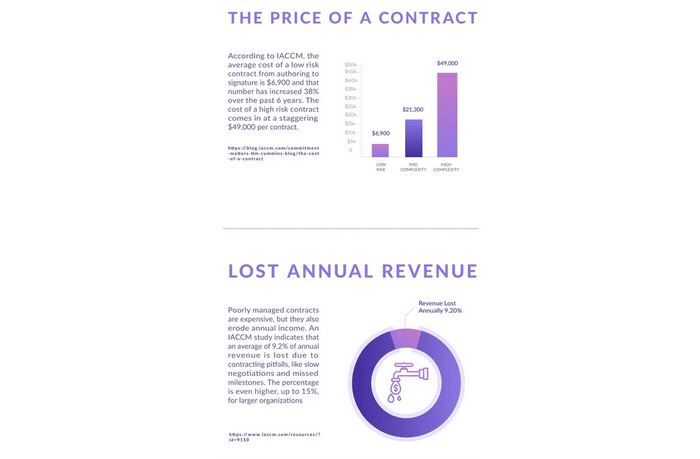

Drafting, negotiating, and signing the contract is a critical step, which should not be taken lightly. You might have put together the best business proposal. But the fact remains that a poorly written contract often results in lost or missed opportunities, irregular cash flows, unavoidable lawsuits, and reputational damage.

We have highlighted seven expert tips to help you present your contract confidently to your client.

What Is A Business Contract?

A business contract is a legally enforceable agreement between two or more parties. It spells out the terms and conditions of a business transaction and contains details like:

- the price of goods or services

- delivery dates

- payment terms

- warranties

- liabilities

Types of business contracts include:

- sales contracts

- employment contracts

- non-disclosure agreements

- partnership agreements

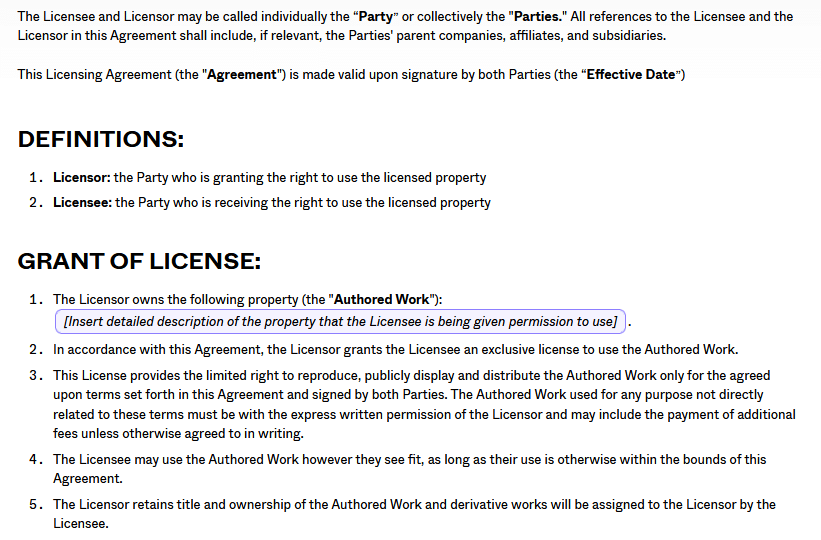

- licensing agreements

- lease agreements

Each contract will have its unique clauses tailored to a specific transaction.

Why Is It Important To Have A Business Contract?

It doesn’t matter whether you start an online store or run a wedding photography business. A business contract is important for several reasons, including:

- Legal Protection: A well-written business contract helps protect your business from legal disputes and lawsuits by defining your relationship with your clients, suppliers, and partners.

- Setting Expectations: A typical contract contains project deliverables, deadlines, and payment schedules. In doing so, it outlines expectations and responsibilities for all involved parties.

- Business Clarity: Many times, verbal agreements are misinterpreted, causing misunderstandings and disagreements. A written contract leaves no room for ambiguity and ensures everyone is on the same page.

- Communication Tool: A business contract is a tool to communicate the terms of the agreement in writing. It allows everyone involved to understand their roles and what is expected of them.

- Dispute Resolution: If a conflict arises, a business contract can be used as a reference to resolve the dispute quickly and efficiently.

Tips To Set Up Your First Business Contract

You do not have to get formal training as a lawyer or paralegal to draft a contract. Yet, contracts must cover all bases for business clarity, legal protection, and dispute resolution.

Here are seven expert tips for setting up your first business contract.

1. Know The Basic Requirements For Drafting A Contract

To be legally binding, a business contract must meet several requirements. Firstly, the parties involved must have the legal capacity and be of legal age. Likewise, a contract should include accurate legal names of all involved parties. Before signing any agreement, find out the legal name of the other party if unsure. Every party must also sign a contract of their own free will, not because someone forced them to.

Secondly, the terms and conditions must be specific and unambiguous. A contract should contain a comprehensive breakdown of each party’s responsibilities and entitlements. This is especially important when you’re hiring a part-time virtual administrative assistant. If so, you should mention their work hours on specific days of the week. After that, you should write the scope of duties. In that, you should outline the parties’ respective expectations and obligations.

As a creative professional, intellectual property is of utmost importance, particularly if you’re a freelancer. Thus, your business contract must also contain all the information related to the ownership and creation of IP. It is also important to add termination clauses and the situations under which the contract can end. Finally, there should be one or more sections discussing how parties can resolve any disagreements that arise. Don’t forget to mention dates for key contract events like approval, renewal, and expiration.

2. Define All Key Terms And Definitions Clearly

When you define what you’re delivering and what you’re not, you set expectations for both parties from the get-go. The more specific you are, the fewer claims you’re likely to have in the future, ensuring everyone is happy.

It’s also vital to read through all the terms of the contract and ensure that every detail is correct. You might even want to consider revisiting the agreement after a few days to allow yourself time to look at it with fresh eyes. This way, you’ll have a better understanding of the contents of the contract and can make more informed decisions.

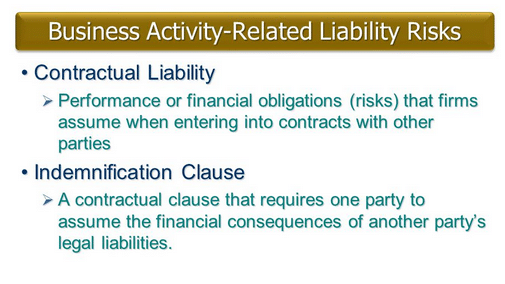

3. Limit Your Liability Risks

It’s common for entrepreneurs to be brimming with positivity and good vibes. Still, they must also be cautious and limit their liabilities. This can protect the company from litigation and reduce the amount of damages it would need to pay.

Limiting liability also allows for better budgeting for worst-case scenarios and can help avoid reputational damage. But, there is a disadvantage. It may result in higher costs for goods or services if customers want to offset their increased exposure. Manufacturers or suppliers may also want to cap their liability, which could affect the profitability of the business.

Thus, you must limit your liability in a contract when specifying realistic warranties and provisions. Set out financial penalties for potential inconsistencies. Ensure that any compensation awarded is within the agreed limit. That way, you’ll safeguard your interests when things go awry.

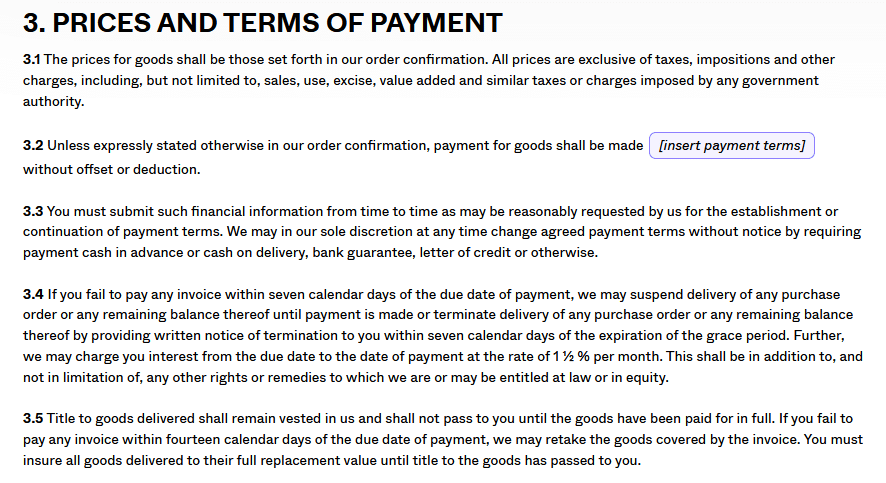

4. Identify Mutually Beneficial Payment Terms

It is important for both the company and the contractor to feel comfortable with the agreed-upon compensation. This is so that they have a successful working relationship and project outcome.

Setting rates as a contractor can be challenging at first, as you want to be fairly compensated but also fear losing out on opportunities. A good place to start is to recognize the value you bring to the table. Then, factor in the cost of benefits and other expenses.

Freelancers and independent contractors offer quality talent without the costs of benefits, paid time off, or office space. But experienced professionals may quote a higher price than a full-time, novice employee responsible for the same duties. So, consider this variable when negotiating a fair rate.

After you’ve settled compensation, specify payment terms upfront and stick to them. This includes writing down:

- what services are mandatory to be paid for

- the date when the payment is due

- how you’ll handle refunds and any applicable taxes.

Having an understanding of these terms ensures that cash flow stays stable. This, in turn, will help you plan for future business-related activities.

5. Make Sure Your Contract Covers Responsibility In Case Of Default

Ideally, you should have a comprehensive contract that outlines the rights and obligations of both parties involved in a business agreement. It should mention the slightest details related to roles, responsibilities, and the chain of command.

In addition, your contract must have provisions on what will happen if any party does not follow the terms of the agreement. This could include clauses on settlements, fines, or even legal proceedings taken in the event of non-compliance. It is equally important to understand the location, industry, or business type-specific scenarios while finalizing the contract terms. Without them, prepare yourself to lose in legal battles later.

6. Consider Having A Lawyer Review The Contract

Legal advice is essential when setting up your first business contract. Working with an experienced lawyer ensures that everything is done according to best practices and adheres to the prevailing laws and regulations in your jurisdiction. Other than that, a lawyer will provide insights on the appropriate contract for your use case. They will correct any oversights and fill any gaps that an inexperienced individual may miss. For instance, they will suggest better terms that protect your rights and interests.

To sum up, a lawyer’s contract review will help mitigate legal risks, avoid unnecessary litigation, and provide legal guidance. In the end, you will get a legally binding contract that’s ready for execution.

7. Invest In A Contract Management Software

If you have the option, consider using good contract management software to create, send, sign, and manage all your contracts remotely. It’s far more efficient and convenient to send and receive electronic copies of contracts than it is to rely on physical paper copies.

Best of all, contract management software offers a variety of contract templates for different purposes. By using these templates, you can ensure that you include all the information that needs to go into your contract. Although not all the language in the templates may be applicable, they can assist in automating your to-do list tasks and making you more efficient. Revising and adjusting templates regularly will make the process easier and more intuitive over time.

Additionally, digital contracts can be quickly signed and saved on a computer to reduce the risk of losing them. Electronic signatures can streamline the process and make it more convenient. However, it is important to understand the legal requirements for different types of electronic signatures to ensure their validity.

Bottom Line

Setting up your first business contract is a significant milestone as an entrepreneur. Business contracts ensure a clear understanding of the risks and benefits involved in a contractual relationship.

Author’s Bio: Qurat-ul-Ain Ghazali, aka Annie, is the growth manager at Contractbook and looks after all the organic channels. She has been with tech startups and scaleups for a couple of years with a B2B focus. You can find her socializing, traveling, indulging in extreme sports, and enjoying the local desserts when she is not working.