Tax season—a time that can send shivers down the spine of even the most organized freelancers. Yet, with the right tools and a strategic approach, it can transform from a period of chaos to one of calm precision. This guide will walk you through leveraging proposal software like Prospero and managing your pay stubs effectively, ensuring that when tax season comes, you’re not only ready—you’re confident

The Role of Proposal Software in Tax Prep

Optimizing Income Tracking with Prospero

As freelancers, our earnings are as varied as our clients. That’s where Prospero comes in—a robust proposal software that does more than help secure the next gig. It’s also a powerful tracking tool. Each accepted proposal is a financial commitment, and Prospero allows you to record these as they come. This isn’t just about knowing what you’re owed; it’s about having an accurate record come tax time. Prospero’s tracking ensures that when you sit down to file your taxes, you have a clear and concise record of your income.

Tips for Income Tracking:

1. Categorize Your Projects: Use Prospero’s categorization features to segment your income by project type, client, or even payment received. This makes it easy to reference for tax purposes.

2. Automate Your Invoicing: Set up automated invoicing within Prospero to ensure that all financial exchanges are recorded without fail.

3. Regular Updates: Make it a habit to review and update your income records in Prospero weekly. This prevents any end-of-year surprises.

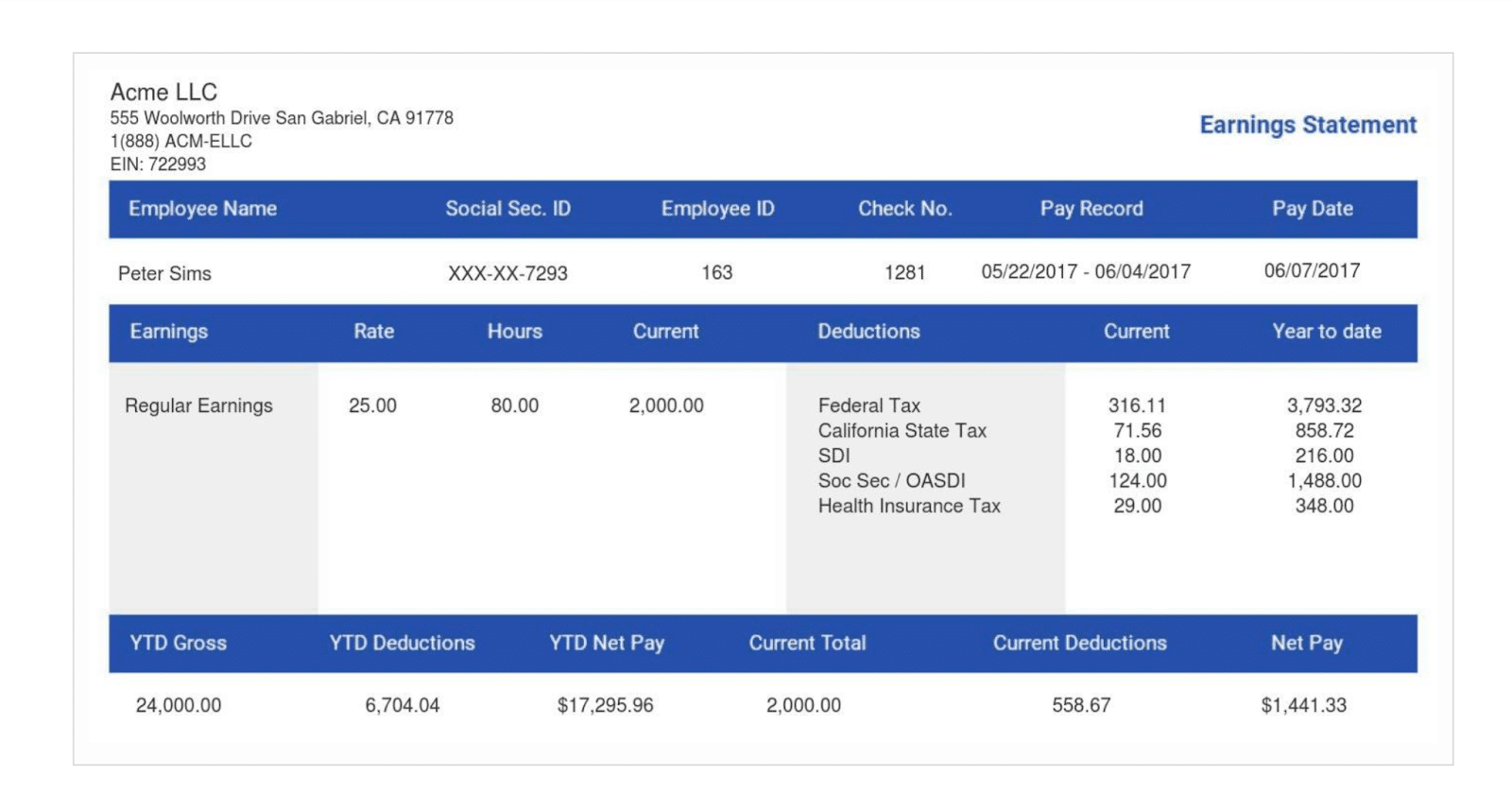

Pay Stub Management: Your Financial Fingerprint

Generating Reliable Pay Stubs

In the freelance world, pay stubs from ThePayStubs.com are your financial fingerprint. They provide a reliable and verifiable proof of income, which is invaluable when dealing with the IRS. But they’re not just for tax authorities—they’re for you. They help you understand your financial flow, track your growth, and plan for the future.

Organizing Pay Stubs Effectively:

1. Digital Storage: Keep digital copies of your pay stubs in a secure cloud storage system, categorized by year and month.

2. Physical Copies: For those who prefer a tangible backup, maintain a filing system with labeled envelopes for each tax year.

3. Review Regularly: Each month, take the time to review your pay stubs, ensuring they match your records in Prospero.

Maximizing Deductions with Meticulous Records

Deductions are the freelancer’s best friend during tax season. From home office expenses to that new laptop you bought for work, it’s crucial to track every possible deductible expense. Prospero can help by providing a space to note expenses associated with each project.

Finding Deductions:

1. Know What’s Deductible: Stay informed about what expenses are deductible. This can include a portion of your internet bill, office supplies, and even software subscriptions.

2. Record as You Go: Don’t wait until the end of the year to record your expenses. Do it in real-time to ensure accuracy and ease of filing.

Common Pitfalls and How to Avoid Them

Misclassification of expenses and forgetting to record income are just a couple of the pitfalls that can trip up freelancers during tax season. Using proposal software like Prospero helps mitigate these risks by keeping your financial records organized and in one place.

Avoiding Misclassification:

1. Use Standardized Categories: Stick to the categories recognized by tax authorities to avoid confusion.

2. Consult with a Professional: When in doubt, consulting with a tax professional can help clear up any uncertainties.

Actionable Advice for a Smoother Tax Filing Experience

Embracing Technology

Prospero is just one tool in the freelancer’s arsenal. Combine it with financial tracking apps, and you’ll have a robust system at your disposal.

Tech Tools for Freelancers:

1. Accounting Software: Consider software like QuickBooks or FreshBooks for comprehensive financial management.

2. Receipt Tracking Apps: Use apps like Expensify to digitally store and categorize your expense receipts.

Staying Ahead: Quarterly Taxes for Freelancers

Understanding Quarterly Taxes

As a freelancer, you’re not just your own boss; you’re also your own tax department. Unlike traditional employees, freelancers need to make estimated tax payments throughout the year, which can be a bit of a tightrope walk if you’re not prepared.

Navigating Estimated Payments with Proposal Software

Proposal software like Prospero can help you estimate these payments accurately by keeping an ongoing tally of your income and expenses. By doing this, you can avoid the year-end sticker shock and potential underpayment penalties.

Record-Keeping Strategies for Freelancers

Digital vs. Physical Records

In the digital age, keeping physical records might seem antiquated, but having a backup can be a lifesaver. This section will explore the pros and cons of both methods and provide best practices for digital record-keeping.

Utilizing Cloud Storage

Cloud storage services offer a secure and accessible way to keep your financial records. We’ll discuss how to organize your cloud storage effectively to ensure that you can always find what you need when you need it.

Freelancer Financial Health: Beyond Taxes

Maintaining a Budget

A good budget is vital for freelancers. It helps manage cash flow, plan for slow periods, and ensure financial stability. We’ll provide strategies for creating and sticking to a budget that works for your freelance business.

Planning for Retirement

Retirement planning is often overlooked by freelancers, but it’s an essential part of financial health. We’ll look at the options available to freelancers, from IRAs to solo 401(k)s, and how to start saving even when income is variable.

Best Practices for Financial Management as a Freelancer

Streamlining Invoicing and Payments

One of the most critical aspects of financial management for freelancers is ensuring that you invoice promptly and follow up on payments. Prospero can automate much of this process, but there are additional steps you can take to streamline these tasks.

Invoicing and Payment Tips:

1. Set Clear Payment Terms: Define your payment terms and include them on every invoice. This sets clear expectations for your clients and reduces the likelihood of late payments.

2. Regularly Reconcile Invoices: Use Prospero to track which invoices have been paid and which are outstanding. Regular reconciliation helps in maintaining a healthy cash flow.

3. Offer Multiple Payment Options: The easier you make it for clients to pay, the faster you’ll get paid. Offer a variety of payment methods to suit different client preferences.

Managing Expenses and Receipts

Keeping track of business expenses is vital for budgeting and tax deductions. Efficient management of receipts will save you time and money when tax season arrives.

Expense Management Tips:

1. Use Digital Tools: Employ digital tools like expense management apps to scan and store receipts immediately. Prospero can also be used to associate expenses with specific projects.

2. Categorize Expenses: Organize your expenses into categories that align with tax deduction categories. This makes it easier to file your taxes and claim deductions.

3. Review Expenses Monthly: Make it a practice to review your expenses monthly. This will help you stay on top of your spending and identify any areas where you can cut costs.

Preparing for Tax Season All Year Round

Tax preparation should be a year-round activity, not just something you think about as the deadline approaches. By keeping your financial records in order throughout the year, you’ll make tax season a breeze.

Year-Round Tax Prep Tips:

1. Maintain Good Records: Keep all your financial records organized and up-to-date using Prospero. This includes income, expenses, pay stubs, and any other tax-related documentation.

2. Understand Tax Deductions: Stay informed about which expenses are tax-deductible. This knowledge can save you a significant amount of money.

3. Work with a Tax Professional: Consider hiring a tax professional who is experienced with freelance taxes. They can offer personalized advice and ensure you’re taking advantage of all possible deductions.

Optimizing Your Workspace for Productivity

The space where you work can significantly impact your productivity. As a freelancer, optimizing your workspace can lead to better work output and, ultimately, financial success.

Workspace Optimization Tips:

1. Create a Dedicated Work Area: Even if you don’t have a separate home office, create a space that is dedicated to work. This helps to minimize distractions and mentally separates work from personal life.

2. Invest in Good Equipment: Invest in quality equipment that will make your work easier and more efficient. This could be a comfortable chair, a second monitor, or professional software.

3. Implement Time Management Techniques: Use techniques like the Pomodoro Technique or time-blocking to manage your workday effectively.

Balancing Work and Personal Finances

For freelancers, the line between business and personal finances can often blur. It’s important to maintain a clear distinction to manage both effectively.

Balancing Financial Tips:

1. Open a Business Bank Account: Keep your personal and business finances separate with a dedicated business bank account. This makes it easier to track business income and expenses.

2. Pay Yourself a Salary: Determine a consistent salary to pay yourself from your business earnings. This helps to manage personal finances and set aside business income for reinvestment or taxes.

3. Save for Personal Goals: Just like you set aside money for taxes and business expenses, it’s important to save for personal financial goals, whether it’s for a vacation, a new car, or an emergency fund.

With these best practices incorporated into your routine, managing the financial aspects of freelancing will become more streamlined and less intimidating. Each tip is designed to build upon the capabilities of proposal software like Prospero and reliable pay stub management, ensuring that freelancers can focus more on their craft and less on the administrative burdens that come with being self-employed.

Conclusion: Embrace the Ease

With Prospero’s proposal software and ThePayStubs.com’s reliable pay stub generation, you can turn tax preparation from a dreaded task into a streamlined process, ensuring that you’re ready for tax season with confidence and ease.

Author’s Bio: Samantha Clark is a Warrington College of Business graduate and she works for the professional accounting firm, ThePayStubs. She handles all client relations with top-tier partners and found her passion in writing articles on various finance and business-related topics.